Based in Zurich, vlot assesses individuals’ and families’ financial status and employer-related social security benefits to help them identify a potential income and/or savings gap. At the beginning of 2023, the B2B2C SaaS solution was rolled out across Generali Switzerland.

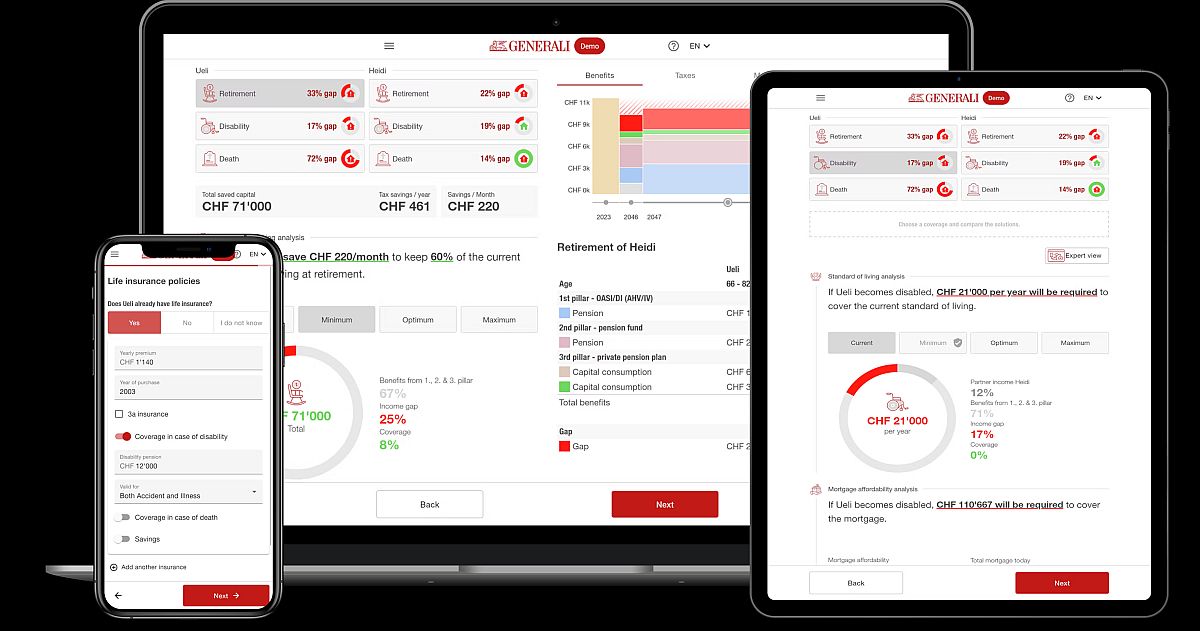

Vlot is a B2B SaaS insurtech dedicated to helping families and individuals make financially responsible decisions and improve their overall financial well-being. The company achieves this through its quick and easy digital solutions that enable end users to intuitively navigate the jungle of state and employer-related social security benefits and rapidly understand the financial impact of death, disability, and the lack of adequate retirement funds. Additional modules include the vlot financial well-being score as an innovative source of customer engagement and a mortgage optimizer for real estate cross-selling.

Available in a self-service setup (websites, campaigns, employers, and pension funds) or in an expert version (brokers and agents), the vlot software can be used for new client advisory, inforce management and retention measures. So far, the solution has resulted in higher sales efficiency, increased customer engagement and loyalty, and highly granular data insights.

The insurtech company collaborates with (re-)insurers, pension funds and banks, offering them API-based architecture for seamless integration of white-label product offerings and underwriting engines for smooth end-to-end digital processes. One of its long-standing partners is Generali Switzerland, which is part of the Generali Group, one of the largest global insurance and asset management providers, with a total premium income of EUR 81.5 billion in 2022 and 82,000 employees serving 69 million customers. Alone in Switzerland, Generali has more than one million customers served by employees at its two headquarters in Adliswil and Nyon.

In 2020, the companies launched a Proof of Concept and have since consistently expanded the offering and solidified their collaboration. Generali has now rolled out vlot across Switzerland, thereby further strengthening the company’s position in the home market. Throughout their partnership, vlot was a resident at Generali’s House of Insurtech Switzerland (HITS), giving it access to infrastructure and physical proximity to one of its clients. “But even more important, the HITS team played a significant role in setting up the initial proof of concept and the subsequent transfer into a long-term production mode,” said Sandro Matter, Co-founder of vlot, as he expressed his gratitude.

“Collaborating with Generali Switzerland and the HITS team has been a wonderful experience. We have not only been able to witness various go-to-markets of our diverse solutions, but we have also grown as a company and increased our headcount to 13 people, 44% more than the previous year. Working with Generali has also enabled us to gain valuable experience in doing business with a large corporate company and getting used to effectively dealing with all the internal processes and relevant stakeholders involved in such enterprise structures,” says Michael Dritsas, CEO at vlot.Ambitious goals to boost profitability

Starting out as a B2C solutions provider, vlot made a strategic decision in 2019 to change its business model to B2B(2C). It has since had a healthy development, with strong growth over the past two years and reaching profitability in 2022. With a set of new features and modules, the entry into new verticals and smart steps towards international expansion, vlot has even higher ambitions – the company aims to further increase revenues by at least 50% in 2023 and ramp up profitability in 2024. Before becoming profitable through its revenues, vlot has been financed by family and friends, business angels, and select venture capital firms.

(RAN)

Please login or sign up to comment.

Commenting guidelines