The launch of Splint Invest made investing in tangible and valuable assets, including luxury products, art, and rare whisky, accessible to a broad audience. With over 200 assets already offered, Splint Invest has become a popular platform in Switzerland and beyond - last year alone, the app saw an impressive 292% year-on-year growth in the invested funds, ascertaining its position as a leading player in the alternative investments sector.

The alternative investing market in Switzerland is experiencing significant growth and development, with MARK Investment Holding SA, the company behind Splint Invest, at the forefront of democratizing alternative investments. The launch of the platform in Switzerland enabled financial inclusivity, by breaking down the barriers to investment opportunities that were once exclusive to a privileged few.

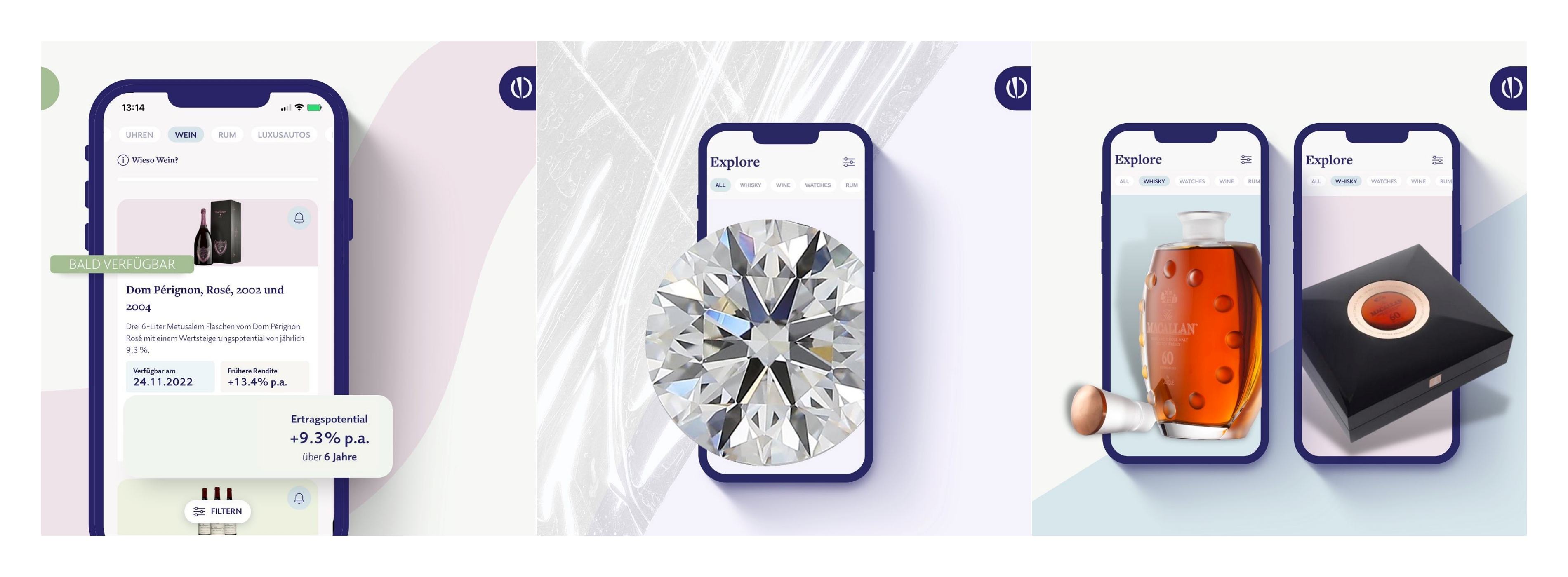

The app, Splint Invest, provides anyone the chance to purchase tokenized shares - called ‘Splints’ - of hand-picked tangible and valuable assets starting with as little as €50, representing co-ownership of physical assets. The entire process, from account creation to investment, taking less than 2 minutes, makes investing easy and fast while ensuring security. The platform has today listed around 224 assets ranging from watches, whiskeys, rare stones, art, cars and most recently photography, allowing investors to diversify their portfolios.

Splint Invest has gained significant traction, with over 39,000 app downloads, 17,000 verified users and almost 10,000 active users – of which 64% are male and 36% are female. These figures were derived from analyzing the users’ first names. More than €11 million has been invested since its inception in 2021, bringing the company’s Year-on-Year growth 292% and 24% month-on-month growth in the amount invested in 2023. Beyond Switzerland, Splint Invest is also famous in the UK and Germany. The addition of French in the app prepares Splint Invest for its debut in France.

In line with the recent growth, MARK Investment Holding SA also continues to gain the trust of investors. To date, the company has raised more than €3.5 million in several rounds from various investors, including business angels, investors from the ‘Höhle der Löwen Switzerland’, Tenity and Venture Kick. Most recently, the startup welcomed Haute Capital Partners on its board, following a strategic acquisition of a 1% stake in the startup to strengthen the firm's presence in the realm of financial innovation.

Thibault Leroy Bürki, CEO of Haute Capital Partners, expresses his conviction about this collaboration: "HAUTE's investment in MARK Investment Holding SA is a strategic step towards diversifying our private equity portfolio. We are also excited by the synergies and future collaboration opportunities that this commitment could generate. The ease of use and innovation brought by the Splint application were essential criteria in our decision. This investment reflects our commitment to supporting financial innovations that not only expand the spectrum of investment opportunities but also facilitate access to these markets for a wider audience."

To support its continued growth and expansion in new markets, MARK Investment Holding SA, which today employs 10 people with 8 full-time equivalents, is planning to raise CHF 5 million series A financing round to accelerate its European expansion plans.

(RAN)

Please login or sign up to comment.

Commenting guidelines