Swiss digital marketplace and transaction platform JAROWA has taken over Mira, making Mitra Solutions AG a subsidiary of the JAROWA Group. With the integration of the Mira solution, JAROWA’s clients profit from fully automated coverage checks, damage calculation and a wide range of analytical data insights to improve their business.

Founded in 2017 in Zug, Jarowa offers insurance companies, property managers, and leasing companies access to a digital marketplace in mobility, property & trades, healthcare, and legal advice. In the case of a claim under insurance, the claim is automatically assessed, and an appropriate and trusted service provider is selected and commissioned to handle the order. The settling of the claim is processed digitally for all parties involved. After reaching “market standard” status in its home market of Switzerland, JAROWA has successfully expanded into European markets and counts leading insurances, property managers and leasing companies among their clients. The recent closure of their Series A financing round for more than CHF 12 million is accelerating JAROWA’s growth outside Switzerland.

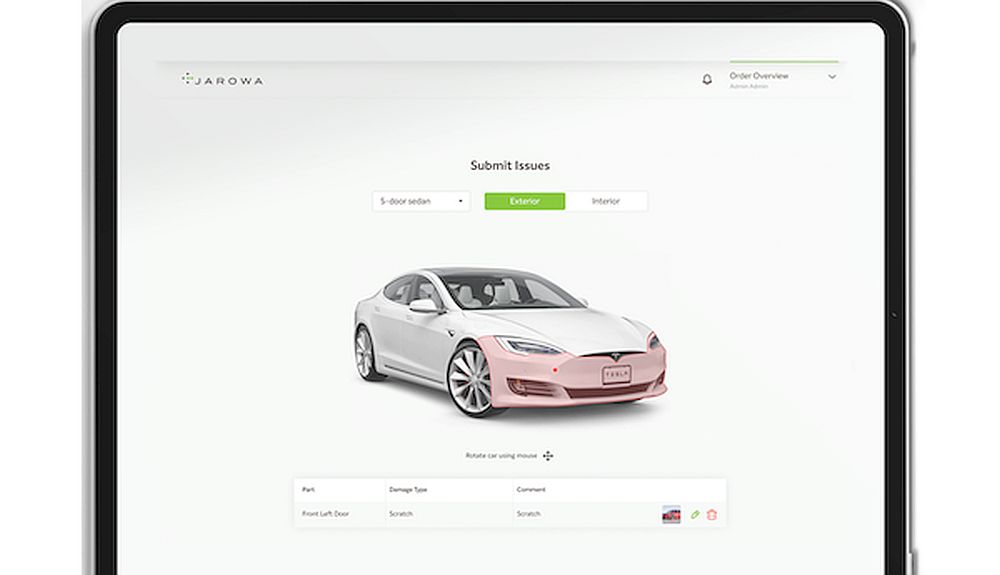

To enhance its offering, Jarowa has fully integrated Mira (formally Mitra Solutions AG), a Winterthur-based startup founded in 2018 by Dandolo Flumini, Joris Morger, Nicolas Gagliani and Alberto Ribeiro Silveira. Mira’s solution contains a visual drag-and-drop contract builder for the simple digitisation of insurance products and the associated policy wording (in particular its terms & conditions) into a “smart contract”.

Enabling a fully digital, end-to-end claims process

In the event of a claim, the smart contract dynamically displays only those questions that are relevant for each individual case. Existing damage reports support the automated check of the coverage calculation and the resulting payment of the claim. Running the claims processes with the Mira solution significantly reduces the effort of manually assessing a claim, and the payments are accurate and fully in line with the policy wording. Additional features, such as automatic value estimation of damaged goods, digital validation of notified events (hail, theft, etc,), smart data insights, customer interaction monitoring and the integrated scenario simulation facility, provide insurance companies with vast amounts of structured data to further improve their processes and products.

After onboarding the Mira solution, Jarowa’s customers can report their claims to their insurance company by using a customer self-service portal or with the support of a call centre agent. Mira’s smart contract engine safely guides the user through the relevant - and dynamically created - notification questionnaire in order to assess and calculate the coverage. Insurance customers then receive an instant cover assessment and, whenever possible, a direct settlement option. A service provider is mandated via the JAROWA platform if damage needs to be repaired.

In addition to the strong benefits of Mira in day-to-day operations and customer interaction, Mira can also help insurers to overcome employee capacity shortages during peak seasons and surge events, such as storms, hail, or flooding. Through its high level of automation, insurers can quickly process many claims related to the same event or even temporarily move the event to a full self-servicing channel specifically activated.

Mira becomes Jarowa’s subsidiary

The acquisition of Mira builds on the startup’s existing relationship, as the two have conducted several successful projects with them since Q3 2021. Mitra Solutions is now a fully-owned subsidiary of JAROWA AG and will be marketed under the JAROWA brand.

Andreas Akeret, JAROWA CEO, states, “We are delighted to be able to offer our clients a fully digital claims process. Access to an automated coverage check and claims calculation solution is a game changer for insurance companies. The service seamlessly connects to our digital vendor marketplace, turning claims handling into a truly digital, end-to-end process. Mira has built the bridge between Claims, Product-Design and Underwriting. We are delighted that the talented Mira team has decided to join our company.”

(RAN)

Please login or sign up to comment.

Commenting guidelines