Geneva-based Impaakt has just launched its "How Sustainable to Me" service, a new sustainable investment tool that allows customers to decide for themselves what constitutes a sustainable business, rather than letting their bank impose its choices. The service is currently available in beta mode until the end of April. A mobile version will be available at the coming official launch.

Impaakt, a Swiss fintech supported by FONGIT, is introducing "How sustainable to me?", a comprehensive service to empower investors with the ability to integrate personal sustainability criteria into their investment strategies.

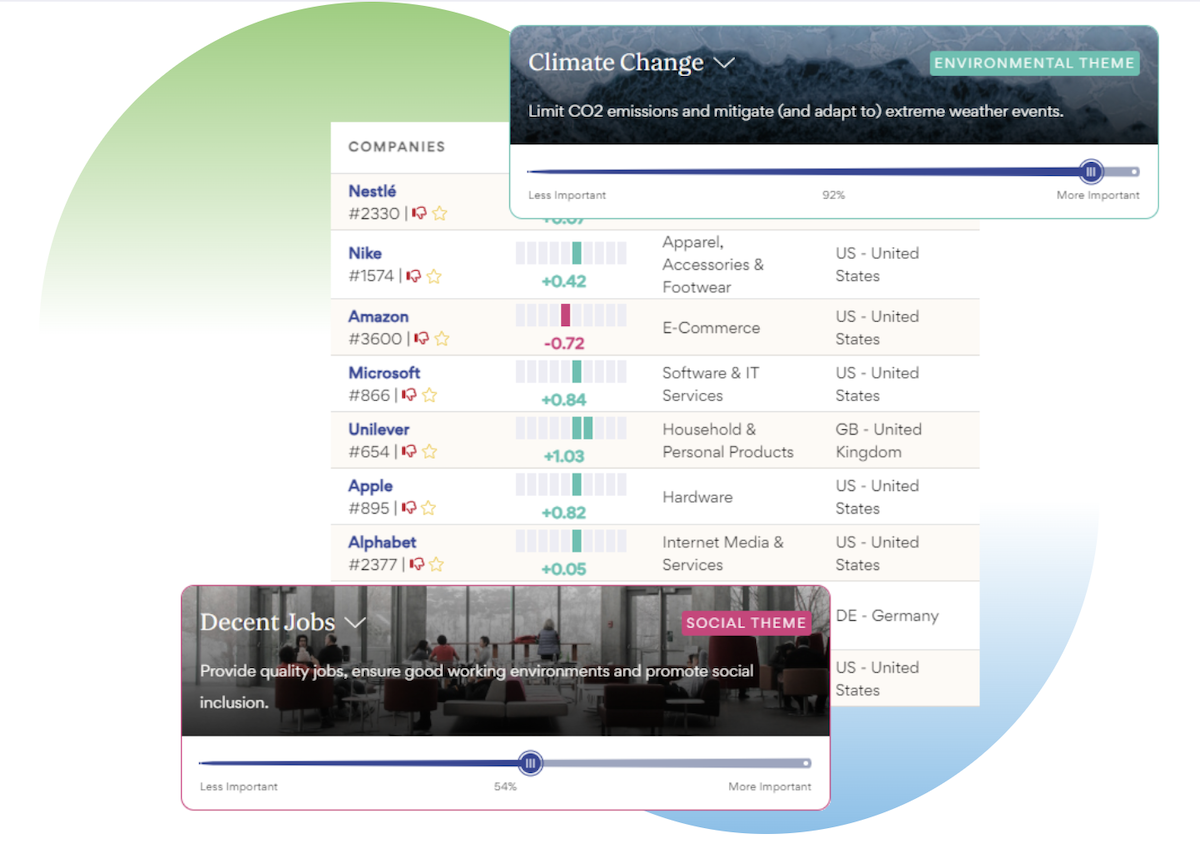

Accessible to all citizens free of charge, this platform will enable users to assess 5,000 companies and receive individualized sustainability scores that reflect their unique values. It will highlight companies as either 'Sustainability Heroes' or 'Villains' based on each user's perspective, ensuring that the subjective nature of sustainability is acknowledged. Additionally, investors can generate custom exclusion lists to remove any companies that don't align with their sustainability ethos from their investment portfolios. The service also facilitates the discovery of investment products, such as ETFs and funds, that closely match the investor’s sustainability convictions. Lastly, it provides a tool to analyze how well an existing portfolio aligns with the user’s sustainability standards, offering a personalized approach to responsible investing.

The ETF (Exchange Trade Fund) consultation system works as follows:

- Free access and unregistered users can access the 4 ETFs best aligned with their profile.

- Free-access registered users (i.e. with a free Impaakt account) can access 12 ETFs.

- Users with a paid subscription (Premium or Pro) can access all ETFs

Contacted by Startupticker.ch, the startup’s CEO Bertrand Gacon stresses that Impaakt is a SaaS solution provider for its customers, who use the platform for two main purposes:

- Companies to engage their stakeholders in the assessment of their impacts (within the framework of the European CSRD regulation)

- Banks and pension funds to consult their clients' sustainability preferences and ensure portfolio alignment or the development of customized sustainable solutions.

As far as promotion is concerned, the CEO explains that all banking partners wishing to create customized sustainable services for their customers can simply use the startup's white-label technology. This enables them to immediately analyze the match between their customers' sustainability preferences and their current portfolios. They can then identify the products (funds/ETFs/mandates, etc.) in their own range that are most aligned, in the spirit of the ASB directive (or MIFID 2 in Europe). Beyond the use of the tool by banks, the startup's strategy is also to promote its services directly to the public through media campaigns and partnerships with networks of sustainable consumers/responsible investors.

Official launch approaching

The service tackling the problem of greenwashing head-on will be available in beta mode until the end of April. This period will be used to gather feedback from early adopters, improve site navigation and introduce new services. The launch at the end of April will also see the introduction of a mobile version (application downloadable from the AppStore or PlayStore).

(ES)

Please login or sign up to comment.

Commenting guidelines