In 2019, the growth of the Swiss biotech industry continued. 250 companies with about 15.000 employees reported a turnover of close to CHF5 billion. These are some of the results from the 2020 edition of the Swiss Biotech Report launched today by the Swiss Biotech Association in conjunction with EY and seven other partners. Although the Corona crisis will lead to a slow-down in 2020 experts do not expects a far-reaching setback.

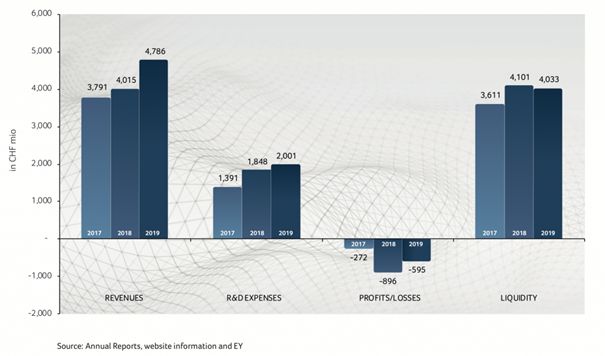

According to the new Swiss Biotech Report, the Swiss biotech industry generated overall revenues of CHF 4.8 billion in 2019, compared to CHF 4.0 billion in 2018. This boost in revenues was mainly driven by favorable collaboration and licensing agreements for AC Immune, Basilea and CRISPR, as well as higher revenues for those biotechs already selling products/services in the market. The long-term success story of the industry enabled the companies to build up a very strong cash position. In total the companies have a liquidity of more than CHF4 billion for example to finance collaborations and / or M&A transactions.

The Swiss biotech cluster does not only include 250 companies that are active in R&D but also service providers, distributors, suppliers and consultants. In total the cluster has about 1000 companies with around 40.000 to 50.000 employees.

Swiss biotechs raised a total of CHF 1.2 billion with an almost even split between public and private companies. In the ecosystem an already attractive funding environment was boosted by new specialized Swiss based funds such as Medicxi, ND Capital, Pureos Bioventures, and Bernina BioInvest together with an ever-increasing number of foreign funds.

In addition the industry index at SIX showed a good performance. The Swiss Bio+Medtech Index (SXI) - was created in 2004. Over the past five years to end Jan 2020, the SXI Bio+Medtech Index has clearly outperformed both the Swiss Performance Index (SPI) by 38% and the NASDAQ Biotechnology Index by 46%.

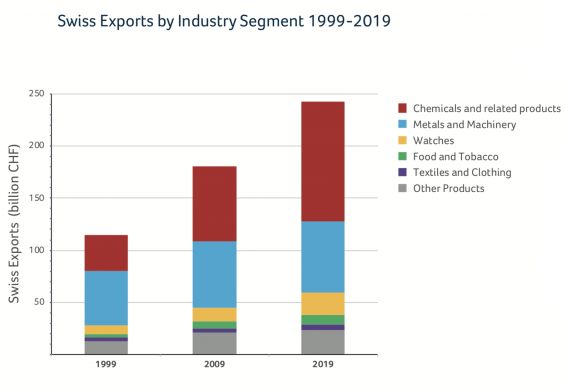

While Swiss exports from all sectors have increased by 112% since the year 1999 to reach CHF 242.3 billion in 2019, the contribution of the life sciences subsector grew by 362% from CHF 21.1 billion to CHF 97.54 billion. This growth demonstrates the strong dynamics of the life sciences sector.

Although the position is very strong, the Swiss biotech sector is not resting on its laurels. The 250 companies in the sector spent more than CHF2 billion on R&D. A growing share of the R&D expenses is flowing into AI projects. The possibilities of artificial intelligence are being exploited for example by companies such as SOPHiA GENETICS, BC Platforms, GenomSys, Genedata, Insphero and SimplicityBIO. These companies are dedicated to use the power of artificial intelligence to enable the development of ever more targeted and effective therapies, supporting and accelerating the development of personalized medicine. Therefore, The Swiss Biotech Association has chosen the topic of big data, artificial intelligence and machine learning as the focus of this year’s report.

Outlook 2020

Jürg Zürcher, Partner, GSA Biotechnology Leader at EY and co-author of the report, does currently not expect a massive setback for the industry as a result of the corona crisis. Certainly, the fight against Covid-19 will lead to delays in clinical trials. However, capacities for such tests are still available. Zürcher also believes that investors will stay active in the sector. This not least because of the continuing negative interest rates. Zürcher is convinced: "If you have a great technology or platform, you can still find resources.”

(Press release / SK)

Picture: Gorodenkoff / Adobe Stock

Please login or sign up to comment.

Commenting guidelines