Start-ups must prepare themselves for a global recession. What do they have to expect? The Swiss Startup Radar provides data-based information on what happened in the Swiss start-up landscape during the last crisis - the financial crisis of 2008.

In general, Swiss startups are relatively well positioned to navigate through a crisis. Their cautious growth strategy and their efforts to achieve early sales help to achieve this. In addition, many companies have experience with services and project business, which can still generate income even if the development of their own product can no longer be financed. On the other hand, the internationally oriented Swiss start-ups are particularly vulnerable when borders are closed.

For the current crisis, the Federation of German Startups has published a list of really helpful resources. The resources range from best practices in internal communication and a "Working from Home Playbook" to a stress test for startups. in Switzerland, Venturelab has also published an article on the topic.

The Swiss Startup Radar shows what effects such a crisis can have and what start-ups have to prepare for, based on the 2008 financial crisis and an analysis of data on around 4000 Swiss start-ups.

Long-lasting decline in venture capital

The financial crisis had a profound impact on investment activity. The number of financing rounds declined significantly from 2009 onwards and remained at a low level for years. It was not until 2012 that a recovery set in, leading to sustained growth in investment.

The strong and continuing decline in investments after 2008 is confirmed by figures from the Faculty of Economics at the University of Basel. According to the analysis of the University of Basel, there were more than 100 financing rounds in 2008. This number was halved in the following years.

It is noteworthy that investments in Israeli start-ups were much less affected. There, the number of financing rounds continued to grow in 2008 and the following years, even though the growth rate was significantly lower than before 2008. This gives reason to hope that the decline in the current crisis in Switzerland, with its now more mature ecosystem, will also be less drastic.

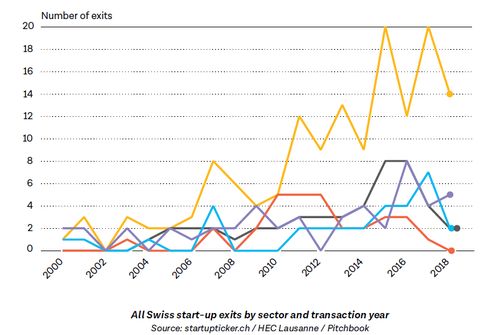

Slump in exits

The number of exits was halved in 2008 compared to the good previous year. In particular, there were fewer exits from software and medtech start-ups. It is also very noticeable that there is only one exit with a known purchase price in our database for the whole of 2008. In 2007, the amount paid for 14 acquisitions had been announced. This suggests that the transactions that still took place in 2008 were less lucrative than those in 2007.

Yellow: Software, red: B2B products, blue: Medtech, violet: Biotech, black: B2B services.

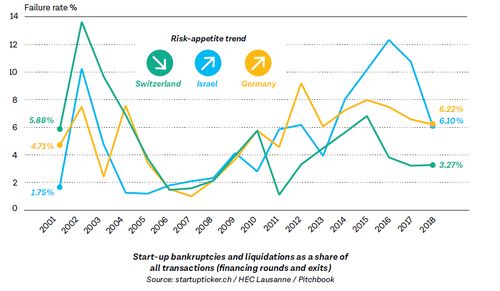

Higher failure rate

The failure rate of Swiss startups was very low between 2006 and 2008, but after this period it increased fast. It doubled from 2008 to 2009 and tripled from 2008 to 2010. However the level was still clearly lower in 2010 than in the years after the burst of the dot.com bubble.

Number of start-ups unchanged

In terms of the number of start-ups founded, there was practically no impact in Switzerland. This is not surprising given the long time horizons in which Swiss start-ups develop, but it is nevertheless an encouraging signal.

Please login or sign up to comment.

Commenting guidelines