Lendity Growth is a new offer in the tech financing scene, providing loans to growing tech startups. More than CHF 60 million in loans have been granted across Lendity’s strategies since 2018, with Smeetz, the provider of an AI-powered pricing system for the attraction industry, being the most recent recipient of a Lendity Growth loan.

The dynamics of the venture capital markets are leading to the rise of a new form of fundraising among startups: debt financing has become particularly attractive for growth-stage companies. Lendity, active in the SME lending space since 2018, recently launched Lendity Growth to provide growth-stage companies access to long-term non-dilutive debt funding as a bridge to their next (potentially larger) financing round or to reach profitability. Similar to a venture capital firm, Lendity Growth is backed by limited partners and offers initial debt funding of up to CHF 3 million per company, although the amounts can increase as the companies grow.

“From a funding perspective, 2024 will be the reality-check year for Swiss startups since many will need to raise again or go out of business. Unicorn-potential Swiss scaleups with exponential growth will likely accept the adjusted valuations and dilution that come with equity since they need to burn large amounts that other funding sources won’t provide. However, many healthy Swiss scaleups are growing below the venture-scale level, which requires more efficient capital. Our non-dilutive solution caters to those scaleups, bringing a significantly lower cost of capital without losing control while being faster to execute. We had a very intense start to the year and anticipate a very active 2024,” said Rafael Karamanian, Partner at Lendity.

While profitability is not a requirement at disbursement, companies that generate monthly recurring revenues of at least CHF 50,000 are eligible for the growth fund. Thanks to its long-term approach, funded companies can pay back according to an agreed loan schedule or if needed, increase the facility size with time.

Smeetz joins Lendity portfolio

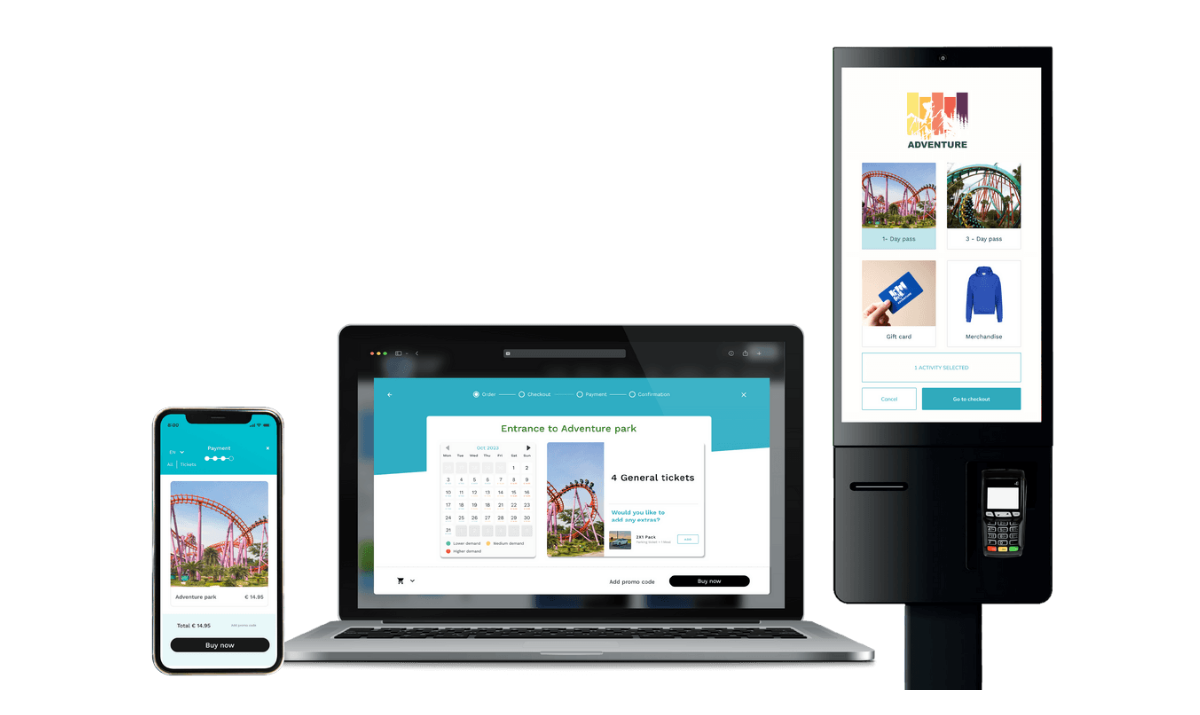

Lendity has recently granted five growth loans to Swiss Tech companies. The most recent loan went to Smeetz, the Swiss-based B2B SaaS company providing a cloud-based unified commerce solution for visitor attractions. Its platform simplifies ticketing operations and harnesses data to optimize revenue. As an innovator in revenue management for the attractions industry, Smeetz leverages AI to gather and analyze customer journey data, thereby boosting revenue and enhancing operational efficiency for venues such as amusement parks and museums. In partnership with Adyen, a global leader in payment solutions, Smeetz offers cutting-edge and competitively priced embedded payment features.

With over 160 clients worldwide, Smeetz serves a diverse customer base with companies such as Otium Leisure’s Fort Boyard Adventures and Chillon Castle, Switzerland’s premier historical attraction with nearly 400,000 annual visitors. The obtained growth capital will fuel the company’s growth.

“Lendity’s solution minimized our funding costs and avoided dilution. This long-term committed capital was a significant advantage over standard credit lines, allowing us to concentrate more on growth and less on continuous fundraising efforts,” said Alexandre Martin, Co-founder and CEO of Smeetz.

(RAN )

Please login or sign up to comment.

Commenting guidelines