The Swiss FinTech industry continued to grow in 2023, especially in the area of sustainable FinTech. However, with the declining financing activities and decreasing attractiveness of Switzerland as a location, there are also signs of a certain cooling trend. This conclusion is drawn from the latest FinTech study conducted by the Lucerne University of Applied Sciences and Arts.

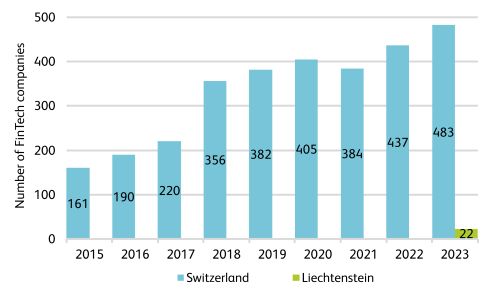

Never before have there been more active companies in the Swiss FinTech sector, totalling 483 at the end of 2023. This represents an increase of around eleven percent compared to the previous year. Compared to 2015, the size of the sector has even tripled, as indicated by the latest FinTech study from the Lucerne University of Applied Sciences and Arts (HSLU). For the first time, the study also considered Liechtenstein and the 22 FinTech companies based in the principality.

The growth was particularly significant among FinTech companies focusing strategically on sustainability, constituting about ten percent of all Swiss FinTech companies. Their number increased by around 50 percent in 2023. "The growth of 'Sustainable FinTech' companies is stronger than that of other FinTech companies," says study director Prof. Dr Thomas Ankenbrand. The interest of investors in sustainable investment opportunities is high. The obligation of banks to inquire about sustainability preferences from private investors further favours this growth, according to the HSLU lecturer.

Figure 1: Overview of the Swiss and Liechtenstein FinTech sector

Location Attractiveness: Switzerland Faces More Competition

According to Ankenbrand, there are also cooling trends: Stockholm has surpassed Zurich and Geneva in the ranking of the most attractive locations for FinTech companies, displacing them from second and third places. Other cities like Amsterdam have also caught up. Therefore, Zurich and Geneva have relatively lost competitiveness. The study director comments, "The rankings in third and fourth place indicate that the conditions for FinTech in Switzerland continue to be favourable." However, the analysis in the study also shows that leading international FinTech locations closed in on the attractiveness of Switzerland last year. Singapore continues to lead the ranking by a large margin.

Declining Financing Activities

Another indicator of a cooling trend is the venture capital activities. Financing for FinTech companies decreased in 2023, both in volume and the number of transactions. A total of 457 million Swiss Francs flowed into the Swiss FinTech sector in 68 financing rounds. In comparison, the previous year saw 605 million Swiss Francs in 84 financing rounds (see Figure 3). Therefore, the financing volume has decreased by about a quarter. According to the study director, it can only be determined in the next few years whether this decline is a structural slowdown or driven by a temporary interest rate effect.

AI: Great Potential for the FinTech Sector

"Although FinTech has evolved from a niche market to a significant innovation provider for traditional financial service providers, the potential for optimising the financial value chain has not been fully exploited," says Ankenbrand. Solutions for the seamless integration of financial services into various application areas (embedded finance) have been implemented sporadically.

The HSLU lecturer sees great potential for the financial sector in the field of artificial intelligence. A dynamic adaptation to new technological developments would bring advantages to Switzerland as a location and the local FinTech sector.

IFZ FinTech Study 2024

The Lucerne University of Applied Sciences and Arts publishes an annual IFZ FinTech Study. This year, for the ninth time, the study provides a comprehensive overview of the Swiss FinTech sector. The research was made possible through the support of e.foresight, Finnova, Inventx, SIX, Swiss Bankers Prepaid Services, Swiss Fintech Innovations, and Zürcher Kantonalbank.

You can order the full study via E-Mail: ifz@hslu.ch

(Press release / SK)

Please login or sign up to comment.

Commenting guidelines