The year 2022 saw an unprecedented surge in venture capital fundraising, according to the latest report by Invest Europe. European VCs raised €23billion, a 13% increase from the €20bn seen in 2021. The results also showed that corporate investors are playing a key contribution to the funds.

The latest report on Private Equity activities in Europe in 2022 has been released by Invest Europe, Europe's representative of private equity, venture capital, and infrastructure sectors. Over 1,170 fund managers from across Europe contributed to the data collection efforts, covering 94% of the €846bn in capital under management as of the end of 2021.

According to the report, Europe's venture firms raised a record €23 bn tin 2022. This amount is 13% above the €20bn seen in 2021. Funds focusing on all stages of Venture & those focused on Early-stage raised 42% of the total for the year. 343 venture funds raised capital in 2022, with 81 of them being first-time funds.

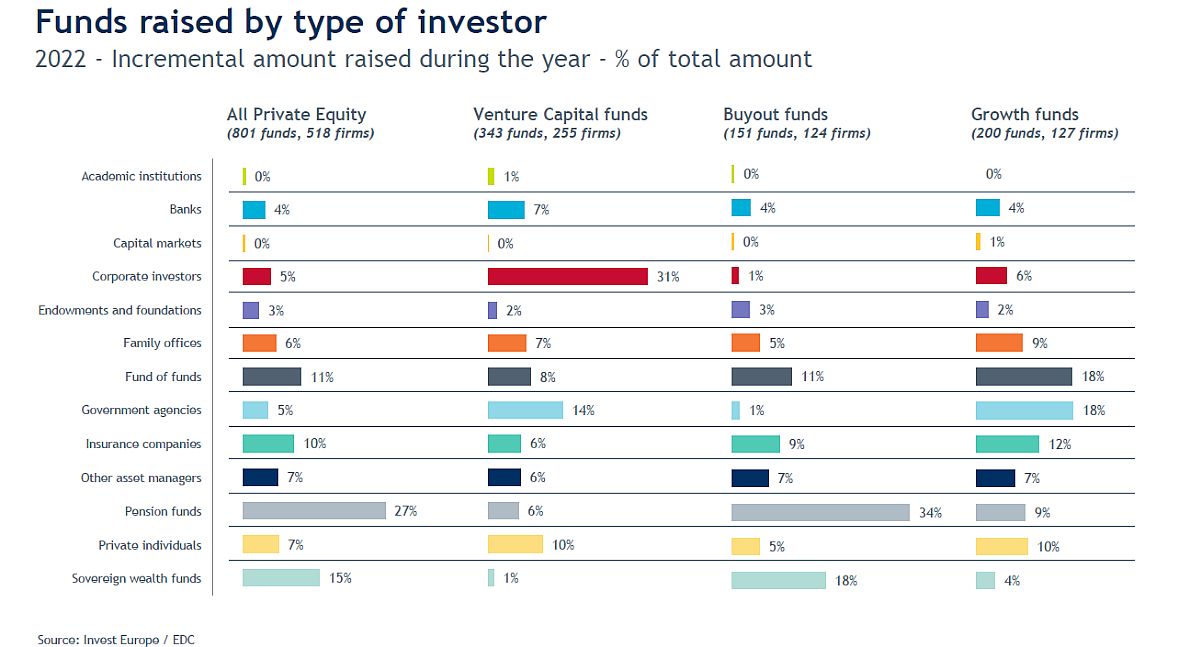

The report presented the origin of the funds, highlighting the importance and role various investors have in the growing VC market. Looking at only VCs, the main players are Corporate investors, which contributed more than a third of the VC funds (31%), followed by Family offices, Private individuals (18%), and Fund of funds and other asset managers (14%).

"Institutional investors – Pension funds, insurance companies, sovereign wealth funds, asset managers - are still cautious about venture capital providing less than 20% of the money for funds raised whereas they provide 68% for buyout funds. Pensions funds in 2022 provided only 6% of the capital raised by VCs as compared to 34% for buyout funds but the percentage has been increasing modestly over the last years", comments former Seca president Ulrich Geilinger.

Furthermore, the report shows that the amount of investment raised and the source varies depending on the region of VC. In the DACH region (Germany, Austria and Switzerland), for example, 37% of capital raised stems from corporate investors, followed by Fund of funds & Other asset managers and Family offices & Private individuals.

Divestments from VC funds

The report found that venture capital divestments reached €2.7bn divested (By the amount of former equity investment or divestment at cost), representing an 11% decrease from the year before. This is also 6% above the average for the past five years: €2.5bn. 1,352 companies were exited, roughly in line with numbers seen over the recent past (apart from 2021’s record year). The main exit route, by a significant amount, was by trade sale (46%) followed by repayment of preference shares/loans or mezzanine and sale to another private equity firm (11% of the amount for both).

The number of years VC hold onto a company has remained stable over the last five years, ranging between 5.7 to 6 years before the exit. Last year, of all existing companies, 41% of the 1305 exited companies by VCs were in the ICT sector, followed by biotech and healthcare (27%), Consumer goods and services (10%) and business products (9%).

Ulrich Geilinger comments: "The number of VC-backed companies that were sold or “exited” otherwise are much lower (around 1’500-17’00 companies during the last years) than the number of companies funded. The same is true for divestment amounts (at cost) vs. the amounts invested. Thus the number of startups still in the VC’s portfolio must have risen quote a lot. And seeking an “exit” for these many companies might prove more challenging going forward as the IPO windows is more or less closed for the moment except for a few high-quality companies."

The full presentation can be domloaded from the website of Invest Europe.

(RAN)

Please login or sign up to comment.

Commenting guidelines