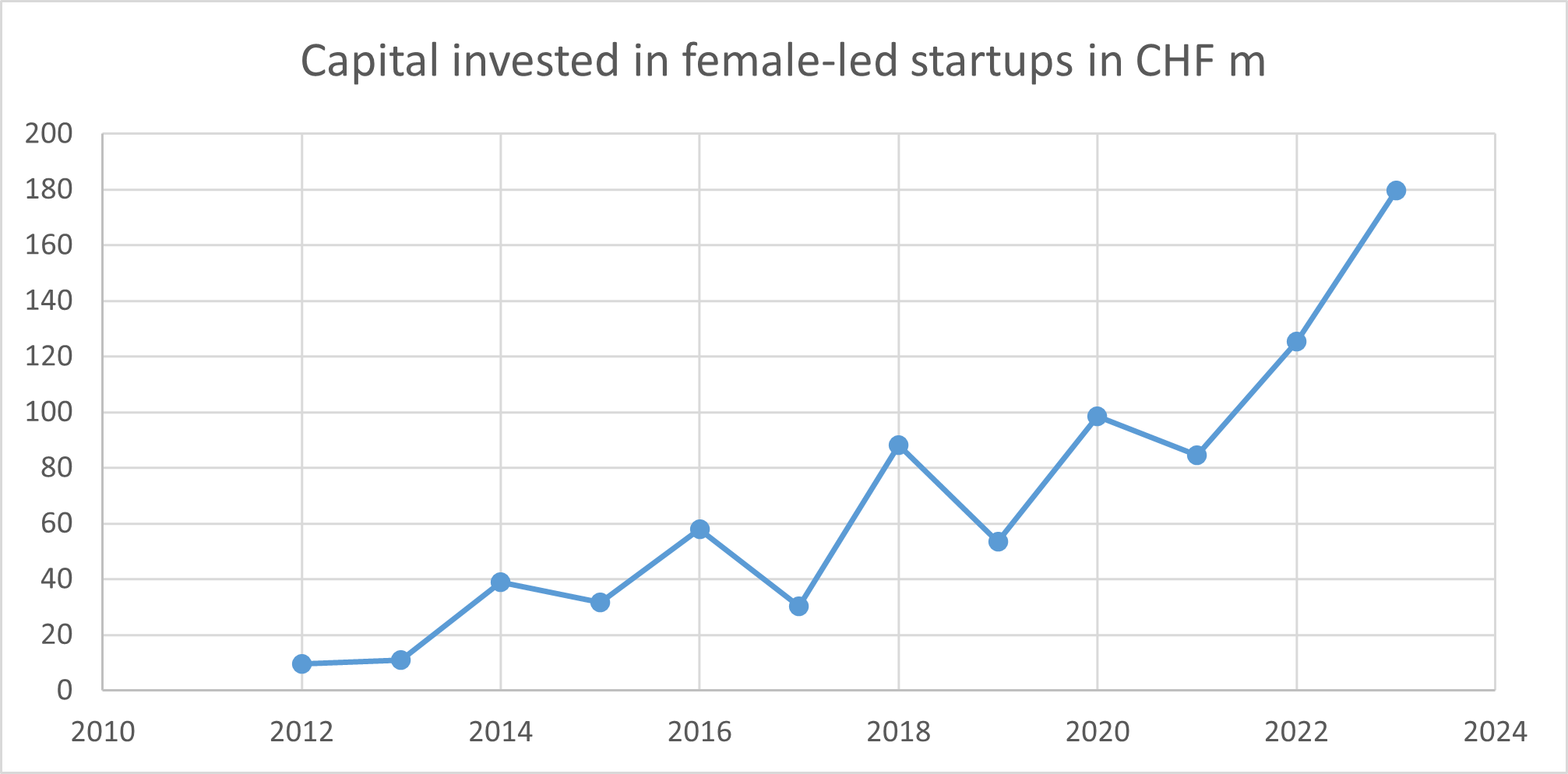

While most investors’ money flows into male-led startups, there is a growing recognition of the opportunity to invest in gender-diverse teams – even though the pace has remained sluggish. Last year, 37 women-led businesses managed to raise a total of CHF 175 million, the highest amount ever raised by women-led startups since 2012. Despite the increase, the percentage of women receiving capital has remained below 10%.

In 2023, the Swiss venture capital landscape experienced a notable downturn, reflecting a decrease in investments across most sectors within the Swiss startup ecosystem. The total number of rounds, encompassing both male and female-led businesses, amounted to 397, with an overall investment totalling CHF 2588 billion as reported in the Swiss Venture Capital Report 2024.

Despite challenging economic conditions in the country, investments in female-led businesses in 2023 made a historical record. A total of 37 women-led companies secured capital, slightly higher than the 36 rounds recorded in 2022, and the total investment injected in these companies increased to CHF 179.74 million (6.9 percent of the total amount invested), compared to CHF 125 million in the previous year across different sectors. The ability of female companies to secure capital not only highlights the confidence of investors in their ideas, technologies, and leadership but also their resilience.

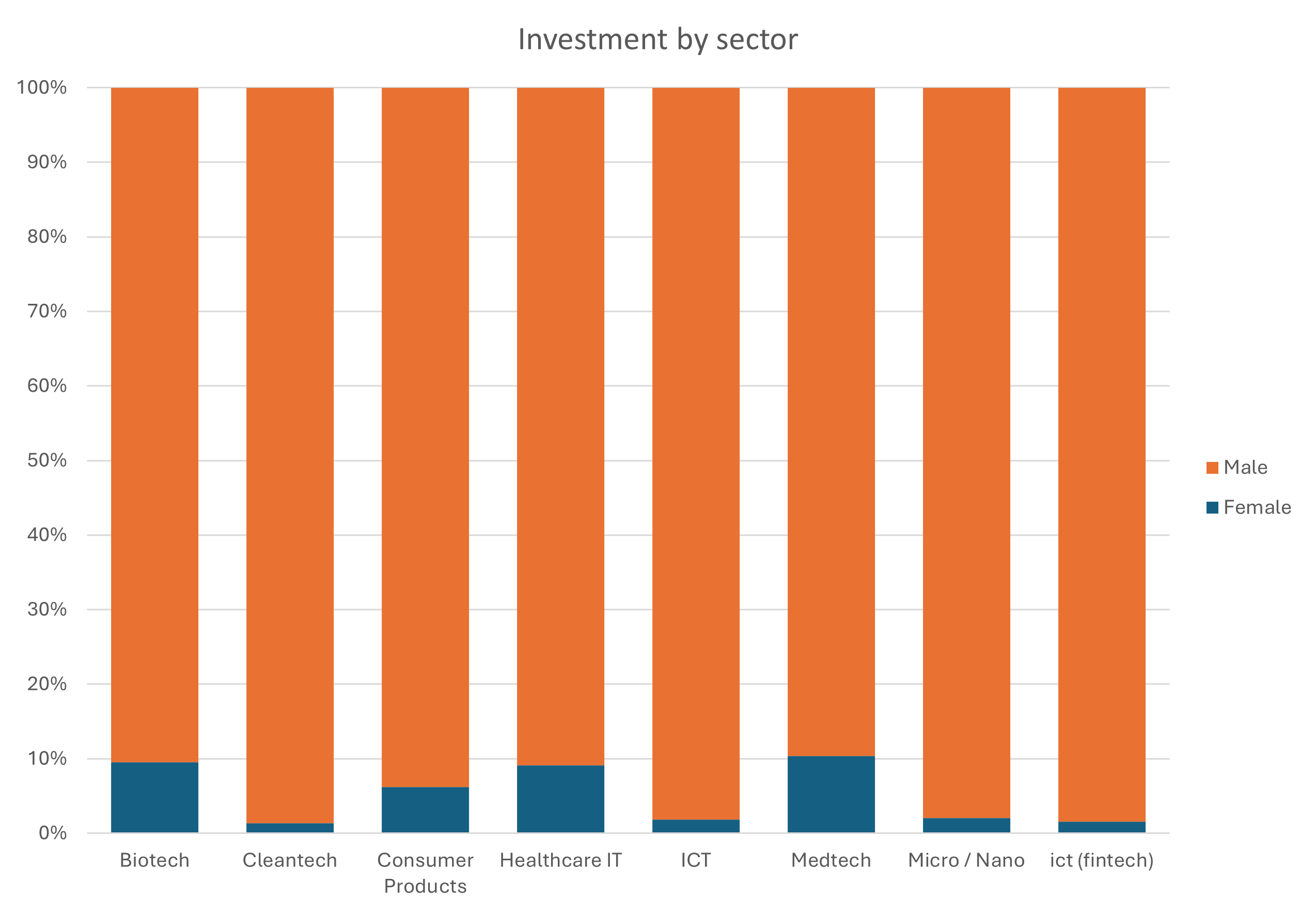

Despite the overall decline, several female-led businesses secured substantial investments, indicative of continued confidence and support within the VC landscape. Notably, four companies closed double-digit-million rounds, with Nouscom leading the pack with a significant investment of CHF 65 million, followed by Artidis with CHF 24.6 million, Tolremo with CHF 20.4 million, and Depoly with CHF 12.3 million. There was wide a range of single-digit-million rounds, underscoring the diversity of investment opportunities. Ryodan Systems AG and Loonawell secured CHF 4.5 million and CHF 3 million, respectively. Nutrix, ellexx, Pregnolia, Terapet, Kuori, Agrinorm, and Health Yourself rounded out the list with investments ranging from CHF 1 million to CHF 2.3 million. The life-sciences and consumer goods sector has remained attractive for investors, as seen by the amount invested.  Ecosystem players in unison

Ecosystem players in unison

The challenges that female-entrepreneurs face are broad, and some may require systematic and cultural change; however, even the smallest steps are needed now to narrow the gender gap in order to drive innovation and fuel economic growth across Switzerland. The idea of providing dedicated support to women-led itself is not new, but observations from the ecosystem have shown that there is a growing number of organizations are actively engaged to provide women with a platform and resources to build thriving businesses.

Many initiatives are still nascent but vigilant to tackle the gender gap. Last year for instance saw supporters publish studies on the underlying problems hindering female founders from getting relevant support to build ambitious businesses. The FemSpin report shed light on the gender disparity regarding spin-off companies, while the FE+MALE Think Tank report revealed how founders’ responses to questions influence investors’ decisions. Collective, an initiative of SICTIC and Startup Days, was established as a first step to closing the gender-gap by showcasing available offers in the ecosystem aiming to nurture female founders. With more than 45 organizations involved, Collective aims to become a one-stop platform where female businesses can find various support offers to push their businesses to greater heights. The Collective Map provides an overview of the available offers.

(Ritah Ayebare Nyakato)

Please login or sign up to comment.

Commenting guidelines