Swiss commodity trading company MUFF TRADING AG has issued the first USD blockchain-based bond on Obligate’s decentralized finance platform, built on the Polygon Network. Set to launch on March 27th, the platform makes it easier for businesses to raise capital and issue bonds by leveraging smart contracts to reduce existing transaction costs.

Obligate, a Zürich-based investment platform that enables companies to issue on-chain bonds and commercial paper to receive funding, has announced the successful issuance of its first USD blockchain-based bond on its regulated platform.

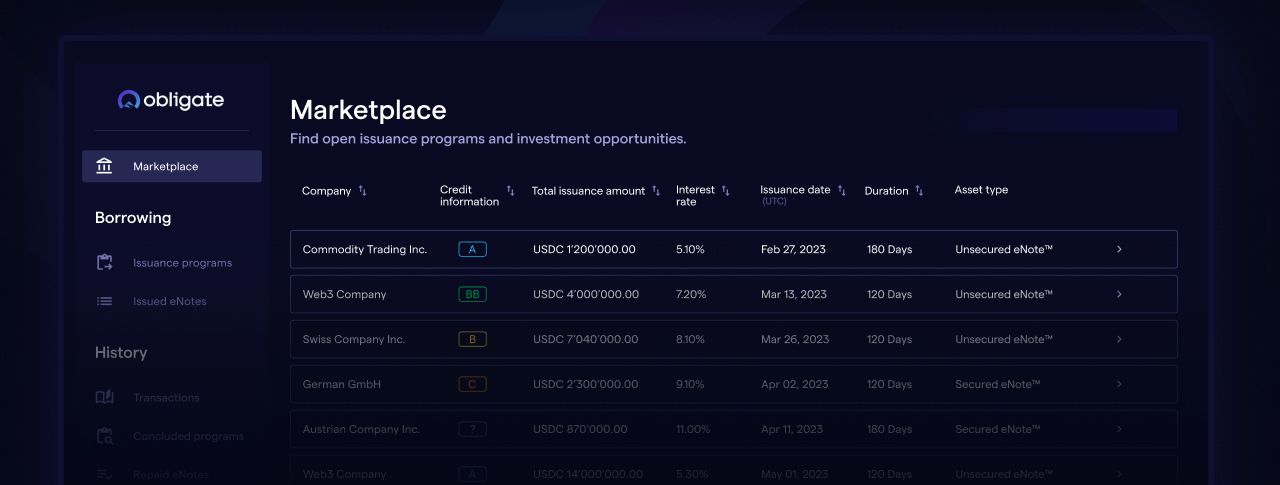

Built on Polygon, the leading L2 blockchain for institutional finance, Obligate’s platform enables the management of corporate debt financing in a decentralized and fully regulated environment and opens access to the bond market for digital asset investors. Smart contracts replace the role of the issuer and paying agent in the settlement layer of traditional bond issuance, while the blockchain serves as both an asset register and trading venue, challenging existing financial market infrastructure.

Ahead of the public launch of the Obligate marketplace on March 27, MUFF TRADING AG issued the first bond on the Obligate platform for an undisclosed amount. MUFF TRADING is a Swiss commodity trading boutique focused on sourcing non-ferrous and precious metal concentrates and minerals. The issuance was conducted entirely on-chain without any banks involved.

Luca Muff, CEO MUFF TRADING commented: “We are glad to open a new and alternative way to finance our physical commodity business. We are proud to issue our first secured corporate bond through Obligate and look forward to increasing the partnership further in the coming months.”

The transaction was secured with receivables held by Obligate partner Apex Group. As opposed to the bond recently issued by Siemens on Polygon, the issuance was entirely funded in USDC and did not rely on FIAT rails for payment and settlement. The issuance is a major step forward in the adoption of blockchain-based borrowing and lending infrastructure by traditional companies and demonstrates that Obligate’s bond platform is mature and market ready for a wide range of participants.

Benedikt Schuppli, Co-founder and CEO of Obligate commented: “The successful issuance of a bond by a traditional Swiss SME taking place fully on-chain, funded with USDC, is a huge milestone for us and the entire RWA space. Combining DeFi rails with the proven regulatory framework for bonds, we are contributing to the transformation of SME financing to increase access to finance on a global scale.”

(Press release)

Please login or sign up to comment.

Commenting guidelines