While the Swiss startup scene celebrates reaching a record CHF 3.1 billion in venture capital investments in 2021, the share allocated to female-led startups has remained proportionally low – only 4.12% or CHF 139.45 million went to 41 startups with female CEOs. These results call for more action from financial vehicles to support women-tech companies.

Investment in female-led startups improved slightly in 2021 compared to the previous year. The number of financing rounds raised from 26 to 41 in 2021, and a total of 139.45 million went to female-led startups, outpacing last year’s CHF 98 million. These figures present rising curves, but on a long-term scale, growth in venture capital investment in female-led companies has remained slow compared to their male counterparts. According to the Swiss Venture Capital Report, the proportion of funding rounds closed by female-founded startups is 10.46%, only 1.96 % more than the previous year. The funding ratio in females and males is 4.12% to 95.88%.

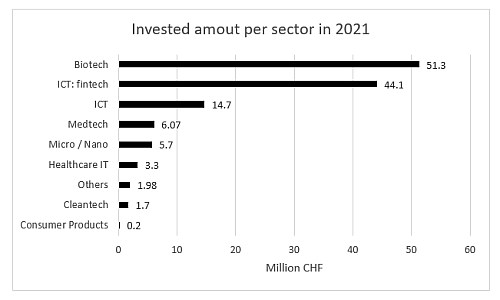

Two startups scored two-digit million amounts in their financing rounds; Schlieren-based biotech GlycoEra raised CHF 45 million while Blockchain startup Concordium received CHF 32. 9 million. The other top investments went to Ledgy AG (CHF 9.2 million), Futurae (CHF 5 million) and Agrosustain (CHF 4.8 million). As observed, the top five financing rounds are startups from different sectors and represent the dominating sectors with the highest financing rounds and investment raised overall.

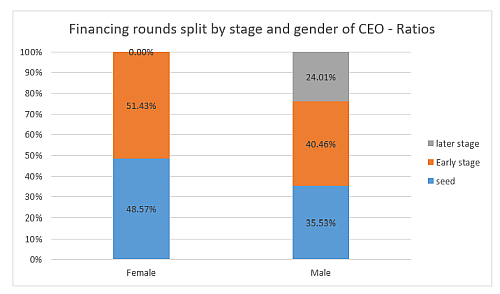

The stage at which startups raise capital also varies significantly compared to their male counterparts. Last year saw more than 51 % and 48 % of female-led startups with early-stage and seed investment, respectively. None of the female-founded startups raised later-stage funding, which is astonishing, given that 24 % of male-led ventures received capital in the same stage.

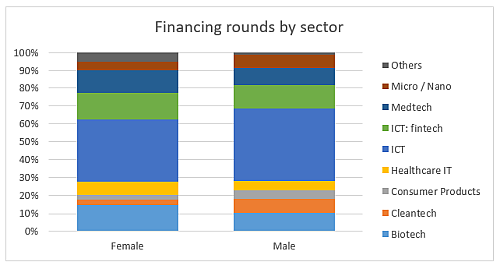

Female startups are active in a broad range of industries whereby there is almost an equal distribution in the number of startups per sector by both females and males. ICT startups led by female entrepreneurs are responsible for a third of the financing rounds, followed by the Fintech and Biotech sectors. The opposite is true in terms of the amount invested. More than CHF 51 million went to the Biotech female-led startups, followed by Fintech and ICT.

Exits

The end of a startup comes after the sale of the company or taking it public. Conventional approaches such as acquisitions by another company were prominent in 2021, with six female ventures taken over. Conversely, no female-led company went public despite having a record-high number of companies listed on the stock exchange. All the 11 startups that went public are male-led.

Based on the 2021 Swiss Venture Capital Report results, it is apparent that female entrepreneurs, just like their male counterparts, are active in various sectors with almost equal representation, yet the proportion of venture capital flowing into female-led startups has remained low. While the reasons for this disparity are inevident, the venture capital landscape plays an active role in this development. They thus should endeavour to ameliorate investment inequality by taking proactive action and investing in more women-led ventures.

(Assistance: Mirco Bazzani, Stefan Kyora)

Please login or sign up to comment.

Commenting guidelines