According to its 2020 annual report, SICTIC investors participated in 51 financing rounds of ICT startups in 2019, contributing a total of CHF 16 million and a median investment size of CHF 1million. The report also highlights how the ICT sector evolved, and provides insights about business models and the preferences of investors.

In its Investment Report 2020, SICTIC demonstrates its growth and traction in the Swiss Startup and Investment Ecosystem. According to the report, SICTIC investors have participated in 51 startup financing rounds of Switzerland based ICT (incl. fintech) startups in 2019. This contribution represents almost half of all investments that were made in ICT startups in the same year – 52 seed and 46 early-stage financing rounds. Because of the high number of investments, the report provides not only insights about SICTIC but also about the Swiss ICT start-up scene in general and its evolution over the years.

Insights about business angels

The number of SICTIC Follow-on rounds more than doubled compared to 2018, with 22 already SICTIC funded startups receiving additional investment from SICTIC Investors in 2019. The recurring investments outline the importance of angel investors during the growth stage of a startup.

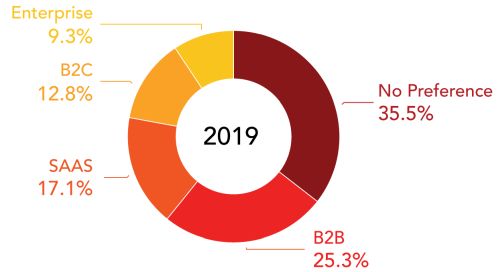

Although the majority (35.5 percent) of the SICTIC investors have shown no preference in a particular sector, a large proportion (25.3 percent) invests in B2B followed by SAAS (17.1 percent), B2C (12.8 percent) and Enterprise (9.3 percent).

Investment preferences of SICTIC members 2019, Source SICTIC

In total, SICTIC has 331 members including 41 (12%) female. The vast majority of the SICTIC members has leadership experience. More one third are CEOs, founders or partners; 16% have management positions, 12% are board members, 10% are heads of departments.

Insights about start-ups

By the end of 2019, the SICTIC Portfolio reached 90 different startups. The report also sheds light on the different business models offered by ICT startups. While the B2B business models are still dominating, the sector has seen an increase in B2C models in 2019 represented by 78.9 percent and 21.1 percent respectively.

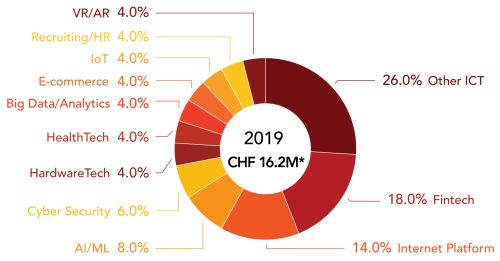

Another intriguing aspect highlighted in the report is the diversity of the ICT sector. In 2017 SICTIC members has invested in start-ups from only 7seven categories. Last year there were almost 20 categories dominated by Fintech, Internet platforms and Artificial Intelligence/Machine Learning and other sectors which include AdvertisingTech, Communication, Digital Asset Management, Drones, EduTech, EnergyTech, LegalTech, TravelTech. This distinguishes Switzerland from Israel, for example, where a few categories such as security clearly dominate.

Investment by Sector 2019, Source SICTIC

Insights on investing

in addition to the analytical part the report includes several articles for business angels for example about topics such as “Who is a lead investor and how to become one?” and “Term Sheet Key Elements of Economic and Control Right” providing insights from SICTIC experts.

(RAN /SK)

Please login or sign up to comment.

Commenting guidelines