With 27,000 users, $350M assets under supervision, and $1BN in volume transactions, Zurich-based fintech company Nummo is making waves in the fast-growing market of personal finance management (PFM). The company serves both the US and Swiss markets and has recently won Visa as its new partner.

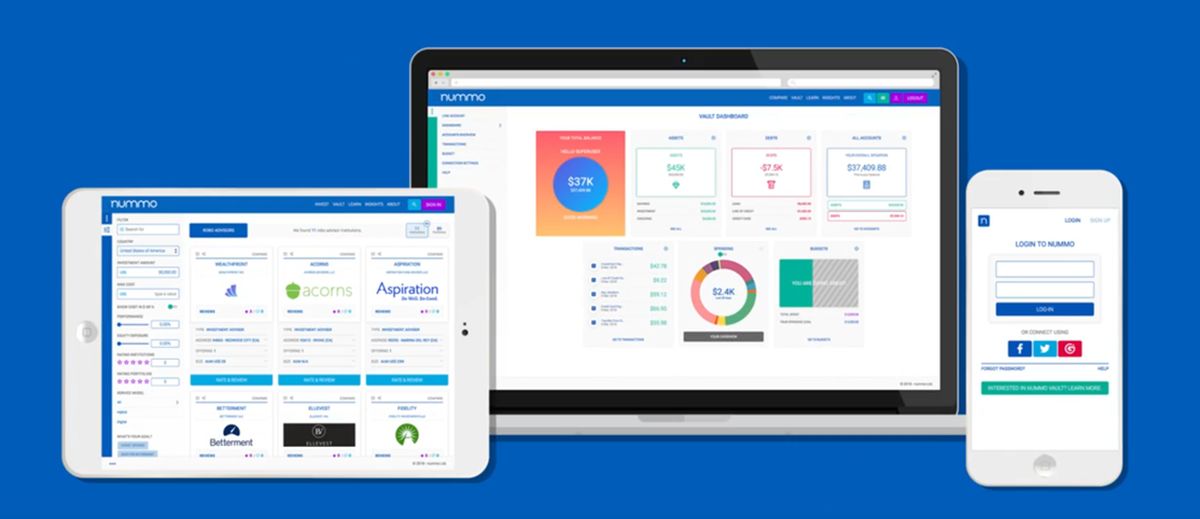

Nummo is a data-driven open-banking PFM platform that enables individuals to manage, maintain and improve their financial health. The company does that through its website nummo.com and an app with a suite of features that allow them to consolidate accounts and manage their money in a completely transparent and conflict-free environment.

Founded in 2016, Nummo is headquartered in Zurich and has operations in Lugano as well. Since closing its $1.9M seed funding in 2018, the company has increased its customer base to 27,000 users for an aggregate of $350M of assets under supervision. Moreover, the platform now manages around $1BN in volume transactions. Nummo is currently closing a new round of funding of $1.5M through a convertible note, which will allow it to continue investing in the growth of its customer base.

A key element to achieve this goal is the partnership agreement with Visa, which was signed at the end of February 2020. “The deal with Visa will give us access to hundreds of merchant offers and special promotions, based on real user behaviour and data. Additionally, Nummo closed a deal with Deposit Solutions to enable users to choose from a variety of FDIC-insured third-party bank deposit products, that is, AuM related revenues”, says Roi Tavor, CEO and co-founder of Nummo. With the intermediate bridge funding and the closing of a pre-series A of $3 and $5 million later this year, the company aims at multiplying the customer base by 10, while increasing the conversion of premium users.

Conventional PFM systems are mostly focused on showing numbers to customers without analysing them or turning them into actionable recommendations. Nummo has adopted a more personalised approach, through AI and its robo-advisor feature, thus steering away from random and unwanted recommendations. Nummo has recently published its “2020 US Robo-Advisor Performance Ranking”, which was featured, among others, in the Financial Times.

(Dimitri Loringett)

Please login or sign up to comment.

Commenting guidelines