AlgoTrader AG, a Swiss based software services providing fully-integrated and automated algorithmic trading platforms has completed a new round of financing with CHF 1.4 million. NeueCapital Partners led the round. The funds will enable AlgoTrader to set foot in international markets.

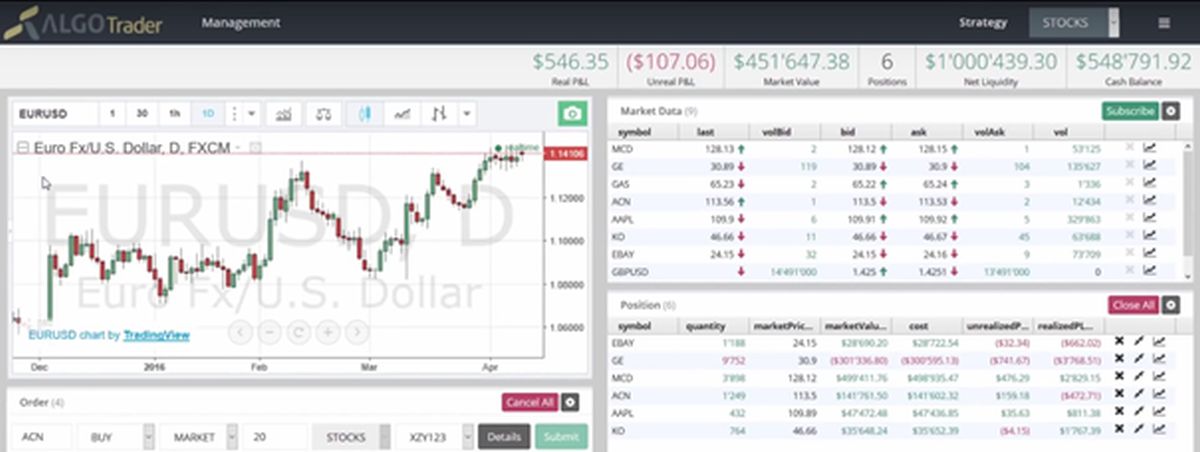

Founded in 2014 by Andy Flury, AlgoTrader is a quantitative strategy design, testing, automation and implementation platform for all security types and asset classes globally, including Cryptocurrencies. AlgoTrader’s functionality and superior modular architecture allows trading professionals to automate their trading strategies in a comprehensive, cost efficient platform.

The startup has now raised CHF 1.4 million post seed round funds, led NeueCapital Partners, a private equity funds focused on healthcare and now expanding its interest in high growth software-technology companies in the fintech space. Angel investors, Spicehaus Ventures a long-term customer of AlgoTrader’s and existing investors of the seed round also participated in the round.

“Since our inception four years ago, AlgoTrader has built one of the most powerful automated quantitative trading platforms in our market space, and we are now excited to get the first funding for our international expansion”, says Andy Flury CEO of AlgoTrader. “We are seeing a tremendous amount of market interest in our solutions and now is the time to expand our business by investing in marketing and sales, product development and international expansion to support the continuing rapid growth of AlgoTrader.”

Christian Janson Euterneck, Partner at NeueCapital also commented on the round: “We were impressed by AlgoTrader’s large international customer base, and the high quality and integration level of its automated trading engine. We are especially encouraged that small and medium sized funds increasingly are using cost-effective and fully automated third-party technology like AlgoTrader, in their trading operations. We believe this will continue to drive strong growth in this market.”

To-date, AlgoTrader’s Clients report that they are able to save budget and speed up time to market for deploying trading strategies given the nature of AlgoTrader’s comprehensive, end-to-end solution. Based on the positive feedback, AlgoTrader believes that it is well positioned to benefit from the continued move towards automated and algorithmic trading across all asset classes.

(Press release/ran)

Please login or sign up to comment.

Commenting guidelines