For the first time, funds, large companies and private individuals have invested more than CHF 2 billion in technology-driven start-ups – an increase of 86% on the previous year – as shown by the eighth Swiss Venture Capital Report published by the online news portal startupticker.ch and the investor association SECA.

Interest in innovative technology and new business models continues to grow. In 2019, venture capital investment in Switzerland increased by more than CHF 1 billion over 2018, reaching an all-time high of almost CHF 2.3 billion, with the number of financing rounds increasing from 230 to 266.

Digital transformation as investment driver

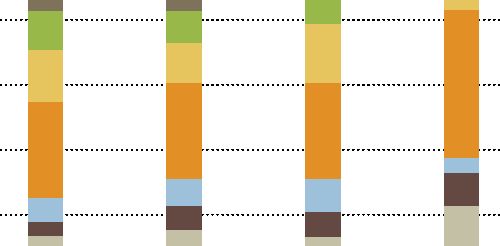

Among the sectors, information and communication technology (ICT) stood out: although ICT start-ups, which also includes fintech start-ups, attracted more than CHF 680 million in 2018, in 2019 the figure reached about CHF 1.2 billion – 10 times as much as in 2012, the first year of the report’s publication. The comeback of biotech is also remarkable: a weak year in 2018 was followed by a new all-time high of CHF 625 million in 2019.

Zurich a Swiss ICT stronghold

Among the cantons, Zurich was top with investment of CHF 1.2 billion, of which almost 90%, about CHF 1 billion, went to ICT and fintech start-ups. From a national perspective, this means that almost 85% of ICT investment made throughout Switzerland went to companies domiciled in canton Zurich. As in 2018, Vaud is in second place, where the cumulative investment amount rose by 70% to CHF 458 million. Start-ups from canton Ticino entered the top group for the first time, with eight rounds and CHF 118.3 million in raised capital.

More and more growth finance

From the perspective of Switzerland as a location for innovation, the significant increase in growth financing in 2019 was particularly pleasing. More than CHF 20 million went to 19 financing rounds, and five rounds received more than CHF 100 million. Four Swiss start-ups achieved unicorn status – ADC Therapeutics, GetYourGuide, Numbrs and wefox – valued at more than CHF 1 billion at the time of the transaction.

Collaborative effort

Once again, data collection was supplemented with confidential information from data partners investiere, SICTIC and Fongit. All information provided on confidential financing rounds by our data partners was individually reviewed in a multi-stage process to ensure that it conformed to the criteria of Swiss Venture Capital Report. Thanks to this collaboration and our own research, the amount of capital invested was determined in almost 90% of all financing rounds.

(SK / JD)

Please login or sign up to comment.

Commenting guidelines