In 2022, start-ups with a female CEO closed more financing rounds than ever before. The amount raised was also higher than in 2021, but female-led startups still only accounted for 9.4% of financing rounds and received only 3.1% of the total capital invested in Switzerland.

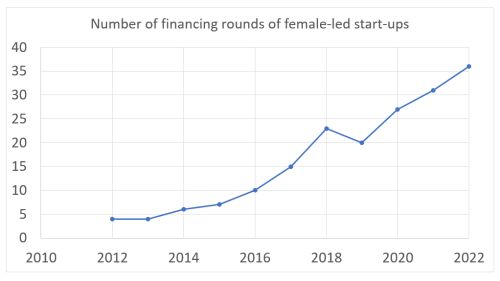

The evaluation of the Swiss Venture Capital Report's data on the performance of female-led startups in terms of venture capital paints a positive picture of the past year at first glance. Startups with a female CEO were able to gain ground for the third time in a row. In a total of 36 rounds, they raised CHF 125 million in venture capital across all sectors. With the exception of 2019, female-led startups have increased the number of completed financing rounds every year.

Proportion of financing rounds has stagnated since 2018

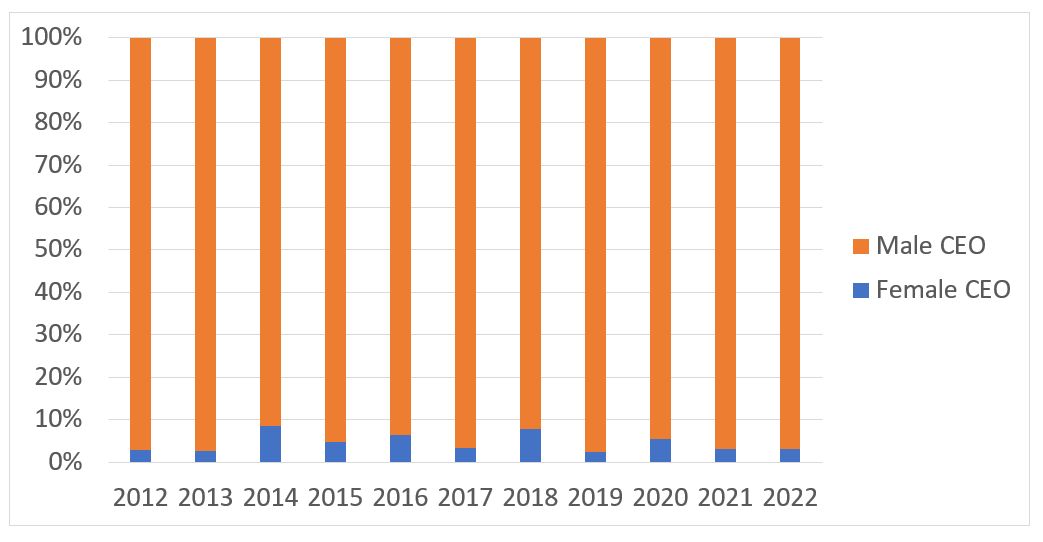

On the other hand, if you look at the share of completed financing rounds of all startups in 2022, the development is sobering: in 2018, the share of completed financing rounds by startups with female CEOS exceeded 10% for the first time. Since then, the share has levelled off around this mark. After two years in a row at slightly above 10 percent, the share fell slightly below this threshold again in 2022 (9.4%). It is true that investments in female-led start-ups are increasing and the amount of total investments is rising. However, the growth is not faster than for male-led startups. The share of total financing rounds is therefore stagnating.

3% in capital for female-led start-ups

The situation is the same with regard to invested capital: The long-standing trend has been confirmed and female-led startups again raised more money from VCs in 2022. But here, too, the share of total capital raised by startups is stagnating at a low level. Only just three percent of the total amount invested flowed to startups with female CEOs, which is once again significantly below the share of financing rounds. The mathematical explanation is simple: It is evident across all sectors that not only the number of completed financing rounds is significantly lower for female-led start-ups, but also the average amount raised per round.

Share of invested capital in female-led start-ups

This chart shows the low level at which the share of investments flowing to female-led start-ups has stagnated. Looking at the period from 2018 to 2022, the average share of all investments is a good 3. 8%. The highest value to date was reached in 2014 with 8. 5%.

Large differences depending on the sector

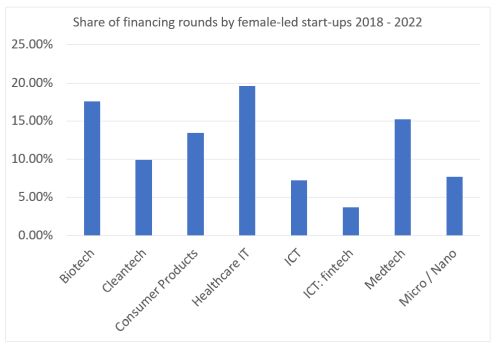

Over the last five years, the life sciences sectors have shown a significantly better picture than the ICT sector and especially fintech start-ups. For the most part, this has become even more pronounced in 2022.

Since 2019, the number of completed financing rounds in the biotech sector has decreased overall. Female-led start-ups, however, were able to increase the number of rounds twice during this period - including in 2022. In this sector, the share of all completed financing rounds is around 20%. This is more than twice as high as the share across all sectors. The share of capital that biotech start-ups received in 2022 is 13. 5%. This figure is also significantly higher than the figure for the share of total investment across all sectors. In the biotech sector, startups with female CEOs were able to raise the most capital, both proportionally and in absolute numbers.

Cleantech and fintech bring up the rear

At the other end of the ranking are cleantech and fintech. According to the Venture Capital Report 2023, both sectors recorded a significant increase in total investment amounts. However, this increase is not evident when looking at the female-led startups in this sector. Cleantech startups with a woman at the helm were able to double the number of completed financing rounds in 2022 compared to the previous year (plus 3 rounds). However, only 0.8 percent of the total venture capital invested in this sector went to female-led startups. In 2021, the share was still 1.3 percent.

In the fintech sector, the situation is even worse. Startups with female CEOs from the fintech sector received only 0.1 percent of the invested capital in 2022 ( CHF 1.5 million in one round; in 2021 still CHF 35.7 million in 4 rounds). Over the last five years (2018-2022), the share in the fintech sector was slightly higher at 1. 6%. In the cleantech sector, the share is less than 1%.

A comparison of the shares of total investments with the shares of financing rounds within the respective sectors shows that only in the medtech and biotech sectors is the share of total investments in female-led startups about half as large as the share of financing rounds. In all other sectors, the shares are even lower.

Please login or sign up to comment.

Commenting guidelines