2021 was a breakthrough year for Climate FinTech. Funding for startups in the space was $1.2 billion, which is 3x higher than in all previous year combined. This is one result of F10’s first Climate Fintech Report. Switzerland is very well positioned in the fast growing vertical.

Climate FinTech is digital financial technology that advances decarbonization. More commonly known Climate FinTech use cases include carbon accounting of large corporations or individual transactions, AI-powered ESG rating of public companies, or transition risk assessments of “stranded assets” according to environmental criteria.

Climate Fintech is a relatively new phenomenon. Just three years ago, the term was practically unknown. The number of start-ups and the total investment generated is therefore still relatively small. F10 assumes that there are around 400 companies around the globe. Less than 8% of all fintech founders consider themselves to be in this field. According to the report, slightly more than one billion euros were invested in the start-ups in 2021. The growth, however, is impressive. In 2021, the total invested amount was three times higher than in all previous years.

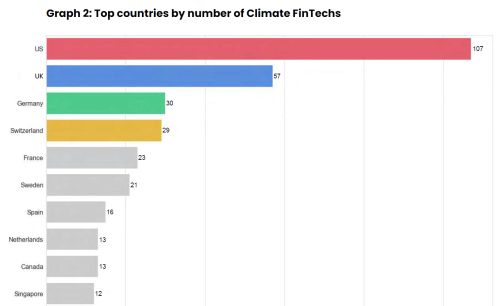

Switzerland has a thriving Climate FinTech ecosystem, with one of the highest, if not the highest, number of Climate FinTechs per capita. According to the report 29 Swiss companies are active in this field. Switzerland is an important gateway for capital flows and wealth management, home to ecologically-minded consumers, and numerous cutting-edge technology research institutions.

As a byproduct of this environment, many Climate Fintechs have found traction from within Switzerland, and a supportive ecosystem has emerged spanning private industry, academia, and the highest levels of government. The Green Fintech Network was set up in November 2020 with the assistance of the State Secretariat for International Finance SIF, who then went on to publish their Green Fintech Action Plan in 2021.

With the prevalence of private banking and wealth management in Switzerland, it is consistent that “ Green Digital Investment Solutions'' is the most active category in the country. The country is also known for its active crypto community based in Zug, with “Digital Asset Solutions” coming in as the second most active category. A map of all companies is included in the report.

Please login or sign up to comment.

Commenting guidelines